To achieve the best results when downloading forms please do the following:

1. Use Internet Explorer

2. Ensure its the latest version of Adobe. Adobe XI (11.0.02) can be downloaded from our website (see below).

Download mp3 westlife mapseverfoundry. 3. Make sure your Pop-up Blocker is off. The Pop-up 'after entering all the data on your form(s), press the PRINT button at the top of the page to populate the barcode to ensure efficient processing of your form' should appear and be responded to by clicking OK to complete the download process.

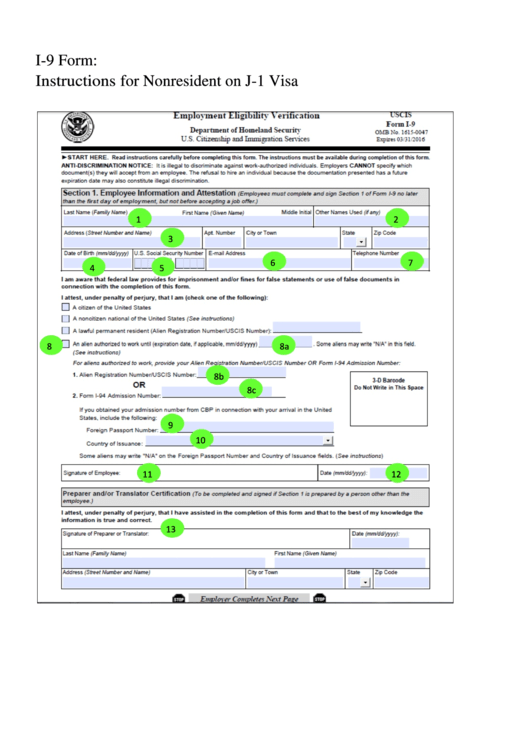

The government has notified the PDF format of all the annual return forms under GST i.e. GSTR 9, GSTR 9A and GSTR 9C. It is mandatory to file GSTR 9 & GSTR 9C annual return forms on or before 28th February, 2021 (revised from 31st December 2020) for the financial year 2019-20. Form I -9 OMB No. 1615-0047 Expires Form I-9 N Page 1 of 4 STARTHERE:Read instructions carefully before completing this form. The instructions must be available, either in paper or electronically, during completion of this form. Employers are liable for errors in the completion of this form. ANTI-DISCRIMINATION NOTICE.

1. Use Internet Explorer

2. Ensure its the latest version of Adobe. Adobe XI (11.0.02) can be downloaded from our website (see below).

Download mp3 westlife mapseverfoundry. 3. Make sure your Pop-up Blocker is off. The Pop-up 'after entering all the data on your form(s), press the PRINT button at the top of the page to populate the barcode to ensure efficient processing of your form' should appear and be responded to by clicking OK to complete the download process.

The government has notified the PDF format of all the annual return forms under GST i.e. GSTR 9, GSTR 9A and GSTR 9C. It is mandatory to file GSTR 9 & GSTR 9C annual return forms on or before 28th February, 2021 (revised from 31st December 2020) for the financial year 2019-20. Form I -9 OMB No. 1615-0047 Expires Form I-9 N Page 1 of 4 STARTHERE:Read instructions carefully before completing this form. The instructions must be available, either in paper or electronically, during completion of this form. Employers are liable for errors in the completion of this form. ANTI-DISCRIMINATION NOTICE.

- The Executive Office of Health and Human Services is the largest secretariat in state government and is comprised of 12 agencies, in addition to 2 soldiers' homes and the MassHealth program. Our efforts are focused on the health, resilience, and independence of the one in four residents of the Commonwealth we serve. Our public health programs touch every community in the Commonwealth.

- All employers must complete and retain Form I-9, Employment Eligibility Verification, for every person they hire for employment after Nov. 6, 1986, in the U.S. As long as the person works for pay or other type of payment. In the Commonwealth of the Northern Mariana Islands (CNMI), employers have had to complete Form I-9.

| Form Number | Name/Description | Latest Update |

|---|---|---|

| DP-10 | Interest and Dividends Tax Return | 01/13/2014 |

| DP-10 Instructions | Interest and Dividends Instruction | 01/13/2014 |

| DP-59-A | Payment Form and Application for Extension of Time to File Interest and Dividends Tax Return | 01/13/2014 |

| Interest and Dividends Tax Estimated Quarterly Payment Forms | 01/13/2014 | |

| DP-2210-2220 | Exceptions and Penalty for Underpayment of Estimated Tax | 01/13/2014 |

| DP-2210-2220 Instructions | Exceptions and Penalty for Underpayment of Estimated Tax Instructions | 01/13/2014 |

| General Instructions | Business Tax Instructions | 01/13/2014 |

| BT-Summary | Business Tax Summary Form | 01/13/2014 |

| BET | Business Enterprise Tax Return | 01/13/2014 |

| BET-80 | Business Enterprise Tax Apportionment | 01/13/2014 |

| BET-80-WE Instructions | Business Tax Apportionment Instructions | 01/13/2014 |

| BET-80-WE | Combined Group Business Tax Apportionment | 01/13/2014 |

| BT-EXT | Payment Form and Application for Extension of Time to File | 01/13/2014 |

| NH-1040 | Proprietorship or Jointly Owned Property Business Profits Tax Return | 01/13/2014 |

| NH-1040 Instructions | Proprietorship or Jointly Owned Property Business Profits Tax Return Instructions | 01/13/2014 |

| NH-1040-ES | Proprietorship or Jointly Owned Property Business Profits Tax Estimates | 01/13/2014 |

| NH-1041 Instructions | Fiduciary Business Profits Tax Return Instructions | 01/13/2014 |

| NH-1041 | Fiduciary Business Profits Tax Return | 01/13/2014 |

| NH-1041-ES | Fiduciary Business Profits Tax Estimates | 01/13/2014 |

| NH-1065 Instructions | Partnership Business Profits Tax Return Instructions | 01/13/2014 |

| NH-1065 | Partnership Business Profits Tax Return | 01/13/2014 |

| NH-1065-ES | Partnership Business Profits Tax Estimates | 01/13/2014 |

| NH-1120 Instructions | Corporate Business Profits Tax Return Instructions | 01/13/2014 |

| NH-1120 | Corporate Business Profits Tax Return | 01/13/2014 |

| NH-1120-ES | Corporate Business Profits Tax Estimates | 01/13/2014 |

| NH-1120-WE Instructions | Combined Business Profits Tax Return Instructions | 01/13/2014 |

| NH-1120-WE | Combined Business Profits Tax Return | 01/13/2014 |

| Schedule II | Combined Business Profits Tax Return Schedule II | 01/13/2014 |

| Schedule III | Combined Business Profits Tax Return Schedule III | 01/13/2014 |

| NH-1310 | Statement of Claim to Refund Due a Deceased Taxpayer | 04/19/2013 |

| DP-80 Instructions | Business Profits Tax Apportionment Schedule Instructions | 01/13/2014 |

| DP-80 | Business Profits Tax Apportionment Schedule | 01/13/2014 |

| DP-120 Instructions | Computation of S Corporation Gross Business Profits Instructions | 01/13/2014 |

| DP-120 | Computation of S Corporation Gross Business Profits | 01/13/2014 |

| DP-120-P | Computation of Partnership Gross Business Profits | 01/13/2014 |

| DP-121 | Non-Consolidation Members of a Combined Group Reconciliation | 01/13/2014 |

| DP-131-A | Net Operating Loss Worksheet | 01/13/2014 |

| DP-131-B | Net Operating Loss Worksheet | 01/13/2014 |

| DP-132 | Net Operating Loss (NOL) Deduction Worksheet | 01/13/2014 |

| DP-132-WE | Combined Group Net Operating Loss (NOL) Deductin Worksheet | 01/13/2014 |

| DP-160 Instructions | Schedule for Business Enterprise and Business Profits Tax Credits Instructions | 01/13/2014 |

| DP-160 | Schedule for Business Enterprise and Business Profits Tax Credits | 01/13/2014 |

| ADDL INFO | Additional Information Worksheet | 01/13/2014 |

| AFFL SCHD | Affiliation Schedule | 01/13/2014 |

| A-101 | Appeals Form | 01/13/2014 |

| ACH-D | Electronic Funds Transfer ACH Debit | 01/13/2014 |

| AU-22 | Certification Request Form | 01/13/2014 |

| AU-201 | Non-Resident Wholesaler Cigarette Tax Report | 01/13/2014 |

| AU-202 | Resident Wholesaler Cigarette Tax Report | 01/13/2014 |

| AU-207 | Qualified Investment Company (QIC) Election | 01/13/2014 |

| AU-208 | Qualified Investment Company (QIC) Report | 01/13/2014 |

| CD-3 | Meals and Rentals License Application | 04/09/2013 |

| CD-15 | Cigarette Stamp Order | 01/13/2014 |

| CD-18 | Tobacco Tax Credit Bond | 01/13/2014 |

| CD-92 | Notice of Intent to Return Damaged or Obsolete Cigarettes to Manufacturer | 01/13/2014 |

| CD-100 | Meals & Rentals Request to Update or Change License | 01/13/2014 |

| DP-9 | Small Business Corporation (S Corp) Information Report | 01/13/2014 |

| DP-14 Bklt | 2013 Meals and Rentals Booklet | 02/12/2013 |

| DP-87- CORP | Report of Change Business Taxes Corporations | 01/13/2014 |

| DP-87- FID | Report of Change Business Taxes Fiduciary | 01/13/2014 |

| DP-87- ID | Report of Change Interest and Dividends Tax | 01/13/2014 |

| DP-87-INST | Report of Change General Instructions | 01/13/2014 |

| DP-87-PART | Report of Change Business Taxes Partnership | 01/13/2014 |

| DP-87-PROP | Report of Change Business Taxes Proprietorship | 01/13/2014 |

| DP-87-WE | Report of Change Business Taxes Combined | 01/13/2014 |

| DP-95 | Election to Report Net Gain in Year of Sale | 01/13/2014 |

| DP-100 | Report of Address Change | 01/13/2014 |

| DP-153 | Medicaid Enhancement Tax Return | 01/13/2014 |

| DP-153-ACH | Medicaid Enhancement Tax Authorization Agreement for Electronic Payments | 01/13/2014 |

| DP-158 | Intermediate Care Facility (ICF) Quality Assessment Return | 01/13/2014 |

| DP-165 | Research & Development Tax Credit Application | 04/29/2013 |

| ACH-C (DP-175) | ACH Credit Registraion Booklet | 04/29/2013 |

| DP-200 | Request for Department Identification Number (DIN) | 01/13/2014 |

| DP-255 | Utility Property Tax Return (includes DP-255-ES Quarterly Payment Forms) | |

| DP-2848 | Power of Attorney (POA) form | 04/05/2013 |

I 9 Form 2013 Pdf Download Adobe Reader

To request forms, please email forms@dra.nh.gov or call the Forms Line at (603) 230-5001. If you have a substantive question or need assistance completing a form, please contact Taxpayer Services at (603) 230-5920.

Google has a different desktop client called 'Drive File Stream'. On its emulated drive, folder size can be easily computed as if files are downloaded to the local disk. This is tested on a Windows. Open a mobile internet browser on your Android. You can use any browser, such as Chrome, Firefox. Find large files google drive. To view Google Drive folder sizes without having to download your entire Google Drive, have a look at the 'preferences' in the 'backup and sync' app. (I'm on a Mac, so.